Mutual Funds, managed by professional portfolio managers, mutual funds allow you to diversify your portfolio by investing in a number of different investments. Mutual funds can invest in equities, bonds, or other mutual funds, and may specialize by industry, sector, or country.

Segregated funds, are pools of investments, similar to mutual funds, but sold as an insurance policy. They offer full or partial principal guarantees if held until they mature or until the fund holder passes away. Therefore, they can be useful in estate planning. Segregated funds also offer protection from creditors. This means that if you go bankrupt or fail to pay your debts, creditors cannot touch the money in this fund.

Benefits of investing in segregated funds:

Guaranteed savings protection

Guaranteed savings protection

Choose one of our guarantees for maturity and death benefits, 75% or 100% of the amount invested, to help ensure your savings remain protected. This means that when your investment reaches its maturity date or when you pass away, if your investment is worth less than its guaranteed value, the insurance protection will top you up. Naturally, it will be proportionally reduced by any withdrawals.

Potential creditor protection

Potential creditor protection

Your investments could be protected even if you face unexpected lawsuits or bankruptcy. With such protection, the death benefit will go to your beneficiaries, not creditors.

Sample Seg funds for yuour reference:

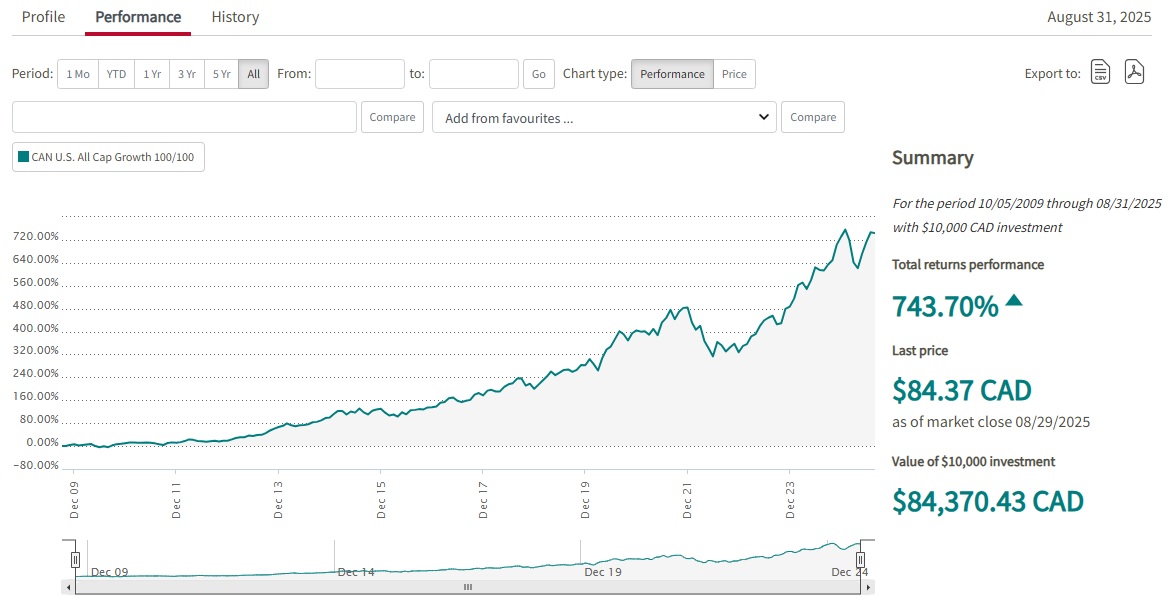

Canada Life US All Cap fund fact-performance:

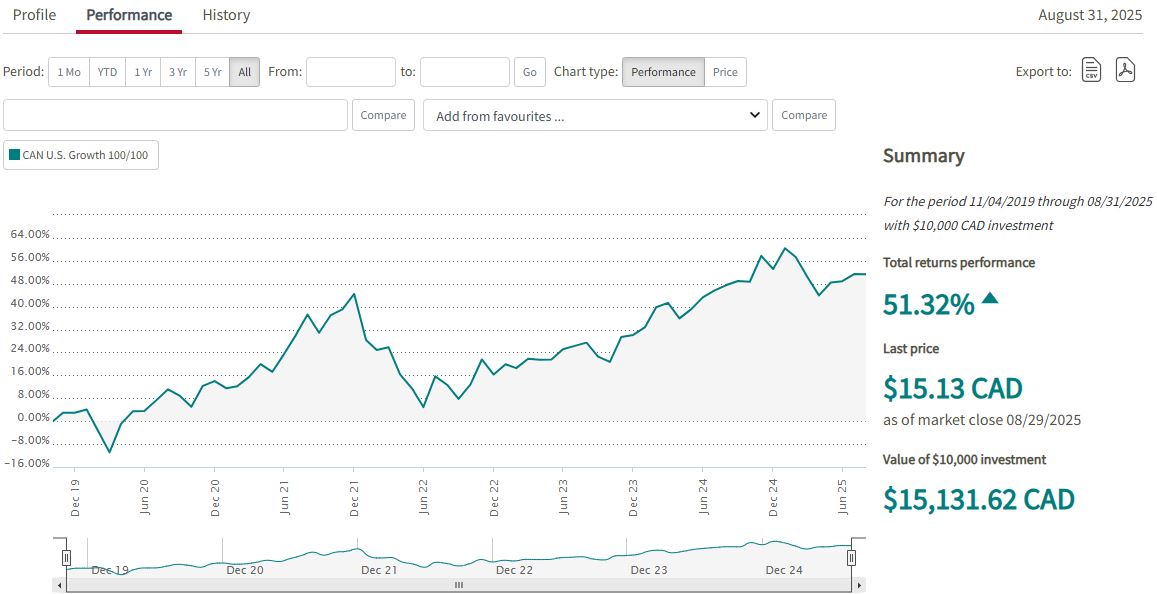

Canada Life US Growthfund fact-performance: